Market Commentary:

Whether you want to point to a sharp drop in the weekly jobless claim benefits or if you prefer to believe like me that in deeply oversold short term conditions stocks shot sharply higher today, with the DOW pushing back over 10,000 again.

Today the Labor Department reported that unemployment benefits fell sharply for the week down to 512,000. That would be the lowest level since last January.

In any case, the stock market saw this as a good omen that perhaps tomorrow’s consistently distorted jobs report, might also be distorted favorably again.

I am crossing my fingers that the fact that the stock market closed at the highs for the day might suggest a pick up in employment ahead of the holiday season.

Economists are hoping for a drop to -175,000 jobs lost, which would be an improvement from -263,000 jobs lost in the previous month. The unemployment rate is expected to rise to 9.9%.

Meanwhile---

It was announced today:

Fannie Mae (FNM/NYSE) reported a net loss of $18.9 billion in the third quarter of 2009, compared with a loss of $14.8 billion in the second quarter of 2009. Third-quarter results were largely due to $22.0 billion of credit-related expenses, reflecting the continued build of the company’s combined loss reserves and fair value losses associated with the increasing number of loans that were acquired from mortgage-backed securities trusts in order to pursue loan modifications.

But there is hope---

As a result, on November 4, 2009, the Acting Director of the Federal Housing Finance Agency (FHFA) submitted a request for $15.0 billion from Treasury on the company’s behalf. FHFA has requested that Treasury provide the funds on or prior to December 31, 2009.

Fannie Mae announced a new program Thursday that will allow some homeowners facing foreclosure to hand the deed back to their lender but remain in the home as a renter.

The idea behind their new "Deed for Lease Program" is that allowing rent-backs will minimize family displacement and stanch the deterioration of neighborhoods plagued by vacant foreclosures, according to Fannie's announcement.

http://voices.washingtonpost.com/local-address/2009/11/fannie_mae_allowing_some_troub.html

Sounds great doesn’t it?

Oh the other big benefit is that Fannie Mae will not have to declare the foreclosure losses on their balance sheets each quarter.

A STEP TOWARDS SOCIALISM

What we really have here is a planned government guaranteed security program at the expense of our liberties as people hand over their deeds to the very government that caused them to lose their homes in the first place.

At least you get to stay and rent for one year while the government provides you food stamps and 20 more weeks for your unemployment benefits, while they spend us into poverty.

I am sorry but must I remind readers that poverty is a form of bondage. Fannie Mae will not have to report how many people are falling into default status and given the fact that the government now owns Fannie Mae, any attempt to hide how many people are losing their homes is just another form of deceit, that each of us as citizens should object to.

I object to the government remaining mute on the fact that oil prices are creeping up to $80 when they know that more and more people will default on their homes and fall into financial bondage to the government.

The industrial achievements of the U. S. are the result of an economic system which is the antithesis of socialism. Our economic system is called 'capitalism' or 'private enterprise' and is based on private property rights, the profit motive and competition.

Sending crude oil prices up again to $14o a barrel will crash the economy. What does that do to private property rights? It trashes them.

We have to wake up people and I think some people are waking up all across the country.

Our country is stepping towards socialism. What is socialism? It is simply governmental ownership and management of the essential means for the production and distribution of goods. We must never forget that nations may sow the seeds of their own destruction while enjoying unprecedented prosperity.

When the press and other propaganda media sources are constantly selling the principles of centralized or federal control of homes, farms, railroads, energy, electric power, schools, steel, maritime shipping, and many other aspects of the economy--but always in the name of public welfare, liberty is being challenged by such creeping socialism.

We need a free economy, a free stock market on the basis of free enterprise. We need to get back to our roots.

Please understand. I don’t mean to pick on any political party but we need to think deeply about where our country is heading here.

EXPENSIVE OR DOES IT MATTER ANY MORE?

With nearly all of the corporate earnings now accounted in the S&P 500 for the third quarter, you might be interested what the facts are straight from Standard and Poor’s.

You can review these numbers by clicking here:

S&P 500 Statistics

As of October 30, 2009

| Total Market Value ($ Billion) | 9,124 |

| Mean Market Value ($ Million) | 18,248 |

| Median Market Value ($ Million) | 7,635 |

| Weighted Ave. Market Value ($ Million) | 75,767 |

| Largest Cos. Market Value ($ Million) | 344,431 |

| Smallest Cos. Market Value ($ Million) | 642 |

| Median Share Price ($) | 31.800 |

| P/E Ratio* | 137.98 |

| Indicated Dividend Yield (%) | 2.09 |

*Based on As Reported Earnings.

Check out the Standard and Poor’s computation of what they think their P/E ratio is for the 500 stocks in their index. At 137.98 times earnings, which allows for the removal of the “mark to the market” accounting rule change, giving banks the ability to value their bad debt at whatever value banks what to value them at, we still have the most expensive market of all time.

The previous highest P/E ratio in history for the S&P 500 was 46 times earnings.

Rather sobering isn’t it?

Is this a free stock market? I think not!

Technical outlook

Friday's economic calendar:

4:00 G20 St. Andrews, Day 1

8:15 Community Bankers Symposium

8:30 Nonfarm payrolls

9:30 Hearing: Employment Situation

10:00 Wholesale Trade

10:00 Briefing: Unemployment data and economic recovery

3:00 PM Consumer Credit

Wow! You can’t make up this much two-way action except with a roulette wheel. For the tourists, Da Boyz got the DJIA back to 10,000 but volume was again relatively light which is mystifying. Once again shorts are squeezed and this two-way action is difficult for most investors to either trade or comprehend. The action today was based on “better than expected” lousy numbers from CSCO and lower Jobless Claims (which, by the way, are still high).

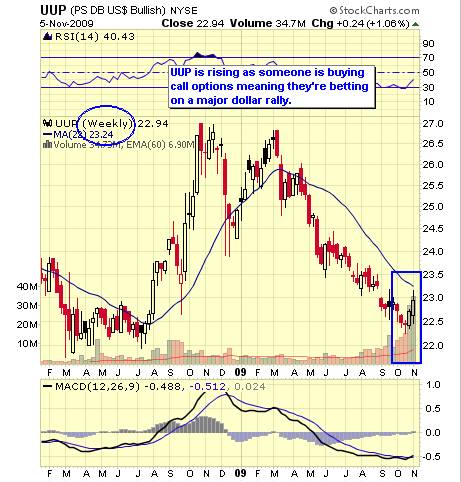

The employment number tomorrow is more important and should further encourage bulls or bears. The interesting story in this post is what’s going on with UUP which is highlighted below within Uncle Buck’s section.

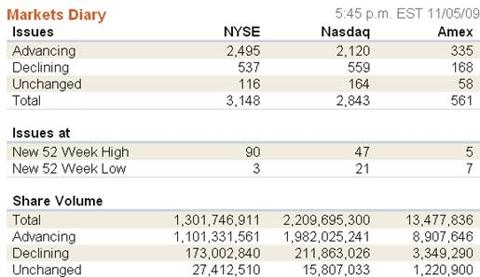

Volume was below recent levels while breadth was excellent.

click to enlarge

| S&P | Trend | Support | Resistance |

| Weekly | Up | 876 | 1200 |

| Daily | down | 1012 | 1110 |

| Vix | Bullish | 20 | 24.50 |

| R3 | 1081 |

| R2 | 1064 |

| R1 | 1053 |

| Pivot | 1047 |

| S1 | 1036 |

| S2 | 1030 |

| S3 | 1013 |

| Oil | Trend | Support | Resistance |

| Weekly | Up | 65.00 | 90.00 |

| Daily | Up | 65.00 | 90.00 |

| Euro | Trend | Support | Resistance |

| Weekly | UP | 1.4304 | 1.5066 |

| Daily | Down | 1.4440 | 1.5006 |

| R3 | 1.5074 |

| R2 | 1.4946 |

| R1 | 1.4835 |

| Pivot | 1.4707 |

| S1 | 1.4596 |

| S2 | 1.4468 |

| S3 | 1.4357 |

S&P500

- Long term trend remains up, and intermediate trend is now Up

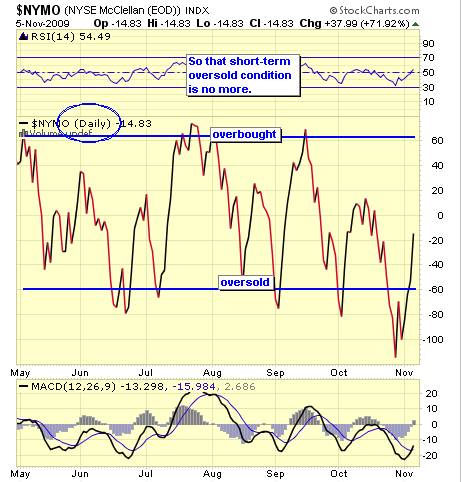

- So I completely got yesterday wrong when writing my comments. No one is perfect, so lets just get up from where we fail down. Yesterday's bullish price action pushed the intermediate trend indicator back up. Now we have all short, intermediate and long term trend pointing higher.NYSE McClellan oscillator is now well out of oversold and we should see this indicator go back to overbought. Market should continue to move higher until another overbought condition arrives.

I think the market will sell off today after the job numbers, as too much bullishness with yesterday's advance. But that does not mean the market is turning lower. With the up trend intact, instead, I will be looking to buy into this sell off.

Crude Oil

- Long term trend remain up , intermediate trend turned up.

- Nothing new with oil, should continue to move higher. But there seems to be a lot of back and forth action around the $80 level. I am not planning on taking this oil trade as there are better opportunities trading gold and silver at this point in time in the commodity market.

Gold

- Long trend remains up while intermediate trend is Up

- nothing new to say about gold, should see price consolidate Friday before another leg up next week. Traders that missed our entry point could enter at a break out point to new highs.

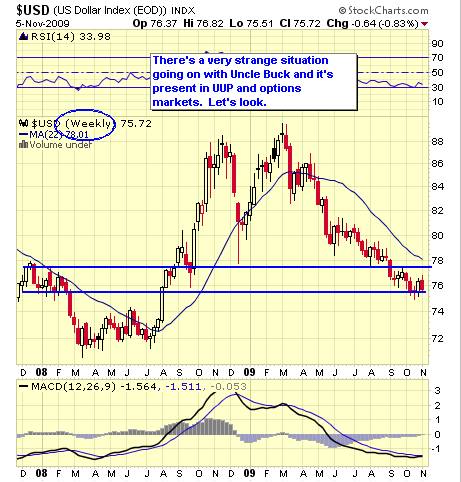

- Long term trend remains down, intermediate trend is now down

- Dollar continues to drift lower as I've indicated. I hold my guidance of $75 by next week.

Below is a press release in part from DB Commodity Services regarding a filing to issue more shares in UUP.

“DB COMMODITY SERVICES FILES WITH THE SEC TO REGISTER 100 MILLION ADDITIONAL SHARES OF POWERSHARES DB US DOLLAR INDEX BULLISH FUND

NEW YORK, November 5, 2009 DB Commodity Services LLC today announced it has filed a registration statement with the US Securities and Exchange Commission (SEC) to register 100,000,000 additional shares of PowerShares DB US Dollar Index Bullish Fund (NYSE Arca: UUP) in order to meet investor demand. Creations of new shares in the fund are temporarily suspended pending clearance of the registration statement by the SEC, the Financial Industry Regulatory Authority and the National Futures Association and declaration of the effectiveness of the registration statement.

Additional information is contained in two related 8K filings which are available at: www.sec.gov. DB Commodity Services LLC.”

Below is the explanation of this activity courtesy of Scott Larison of Forefront Advisory Services:

The market has lost its dominant trend the past month, substituting lots of action but no real progress. That will change eventually but no one likes trading range markets. Just when you think markets are starting in one direction we reverse course. Clearly, after a 50-60% gain from March lows, consolidation is not unexpected. I’d be most careful of January since bulls may prop things up artificially through the holidays.“The demand for UUP NOV. 23 calls the past week may be related to a Hedge Fund taking a shot on the Dollar bottoming out. Open interest in these calls has skyrocketed the past week and is registering nearly 300k contracts or nearly $30 million in underlying value. As customers buy these calls, market makers who sell them must buy stock to hedge these call sales. Here is the past 10 day volume of the calls vs puts, and the open interest of the calls and puts. AVGATM VOL = Average at the money implied vol of the front mo options- notice the spike.”

Date Calls Puts CallOI PutOI AvgAtmIV Close

10/22 8631 563 274k 36k 13.6% 22.31

10/23 19k 488 280k 37k 11.4% 22.43

10/26 69k 4352 295k 37k 14.1% 22.58

10/27 65k 863 352k 41k 13.2% 22.64

10/28 183k 2879 393k 41k 13.7% 22.73

10/29 28k 3249 552k 43k 12.5% 22.57

10/30 46k 2644 566k 45k 13.3% 22.70

11/2 44k 160 596k 46k 17.4% 22.62

11/3 45k 322 621k 46k 14.0% 22.68

11/4 403k 2822 630k 46k 15.4% 22.51

Should these bets pay-off for the speculator(s) it would be a negative for gold and other commodities as well. But, somebody has wind of something to cause the dollar to rally whether it’s from central bank interventions or a policy change or….? Certainly, not all hedge funds are perfectly smart but, as we’ve seen lately, they’re better “informed”.

Most interesting today is what’s going on with UUP. Who is making these big bets? What information do they have we don’t? We’ll find out eventually but if these speculative positions pay off for them, it could upset a lot of positions particularly in commodities and perhaps Emerging Markets as well.

--

Michael Chang

Technical Analyst

Washington Asset Advisors

No comments:

Post a Comment